As a health insurance broker, you know that choosing the right plan can be overwhelming for your clients. With so many options and technical jargon to navigate, it’s no wonder they turn to you for guidance. But have you considered marketing the skills that set you apart from other brokers? By highlighting these essential skills, not only will you make your clients feel more confident in their decisions, but you’ll also establish yourself as an expert in the field. So let’s dive into the top five skills every health insurance broker should market to their clients!

1. Give Your Clients Options

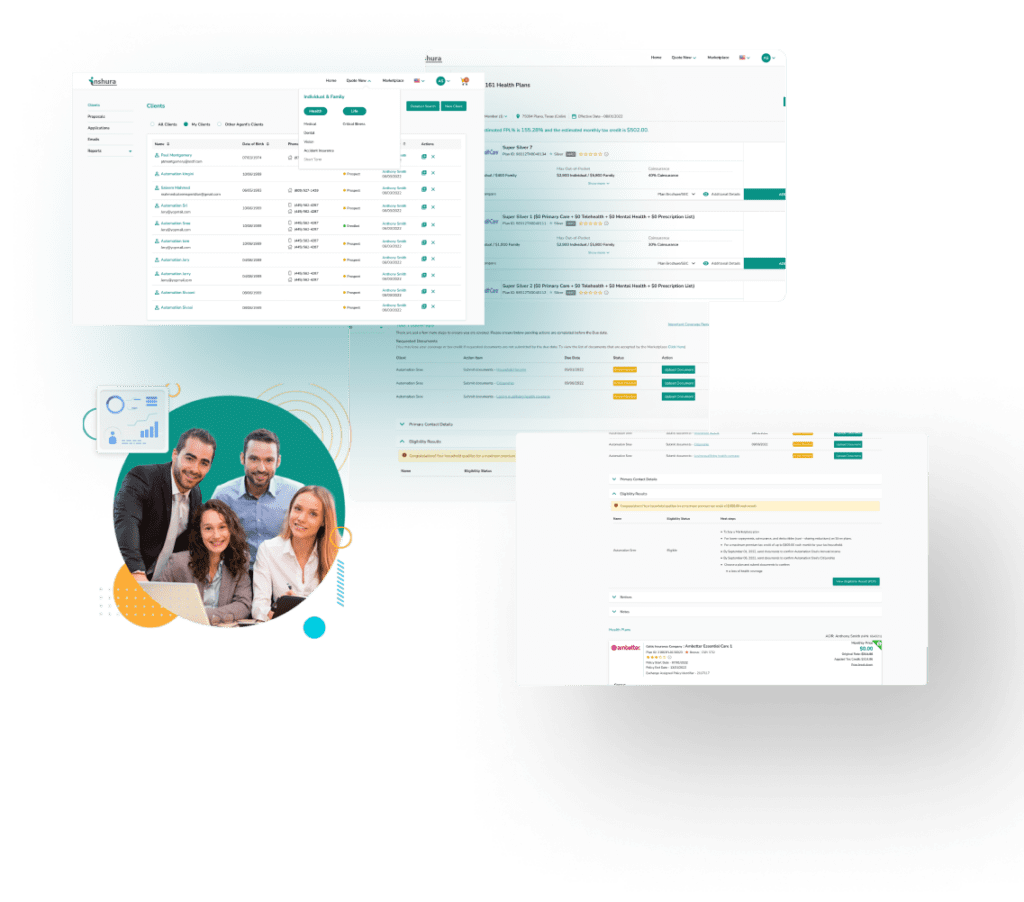

Giving your clients options is a crucial skill for any health insurance broker. By presenting various plans, you’re empowering your clients to make informed decisions that best fit their unique needs and budget. There are traditional fee-for-service plans, Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Point-of-Service (POS) plans, and more. Each plan has its own benefits and drawbacks, so by presenting all of these options to your clients, they can choose which one works best for them. Try using a quoting and enrollment platform, such as Inshura.com, to show your clients the various health plans available to them.

Keep in mind that simply offering multiple choices isn’t enough. It’s also essential to explain each option thoroughly. Take the time to discuss key factors, such as premiums, deductibles, co-payments, out-of-pocket maximums and network coverage restrictions. Make sure your client knows exactly what they’re getting from their chosen plan. Detailed explanations of each health insurance plan will help them feel like an active participant in choosing their healthcare rather than feeling overwhelmed by complex terminology or limited choices.

2. Show Your Expertise

As a health insurance broker, it’s important to showcase your expertise to your clients. Your knowledge and understanding of the industry can help them make informed decisions about their healthcare coverage.

One way to demonstrate your this is by staying up-to-date on changes in laws and regulations related to health insurance. Clients will appreciate knowing that you are knowledgeable about current trends and able to advise them accordingly.

Another important aspect of showing your expertise is providing personalized recommendations based on each client’s unique needs. Listening carefully to their concerns and making tailored suggestions for appropriate plans will build trust with your clients. Take time to research any queries you don’t know the answer to, rather than guessing or giving incorrect information.

3. Help Clients Stay Focused on Their Businesses

As a health insurance broker, one of the most important things you can do to add value for your clients is to help them stay focused on their businesses. Health insurance is just one element of running a successful business, and it’s easy for entrepreneurs to become overwhelmed by all the details. Here are some ways you can help:

- Take the time to understand your client’s specific industry and business needs. By doing so, you’ll be able to provide tailored advice that speaks directly to their challenges and concerns.

- Consider offering additional resources beyond just health insurance plans. Provide tools or connections with other professionals such as accountants or lawyers who specialize in assisting small businesses.

- Be proactive in checking in with clients regularly. Inshura.com is a great tool for managing your clients needs and improving communication. This will show them that they’re not alone in navigating the complexities of owning a business while also managing employee benefits like healthcare coverage.

- Encourage your clients to focus on what they do best – running their business – by taking care of many of the administrative tasks associated with managing employee benefits themselves!

4. Educate Your Clients

Client education is an essential component of any successful business. One way to educate your clients is by providing them with easy-to-understand educational materials, such as brochures, infographics or videos, that explain complex terms or concepts related to their health insurance coverage. This will help them make informed decisions about their policies.

You should also be available for one-on-one consultations where you can answer questions and provide guidance on specific aspects of their plan. Be patient and listen carefully. It’s important not only to educate clients about what they’re health insurance plan covers, but also what it does not cover. This helps avoid misunderstandings or surprises when it comes time for claims processing.

Encourage your clients to stay engaged with their healthcare providers and take advantage of preventative services such as regular check-ups and screenings. Educating them on how these services can lead to better overall health outcomes will show that you care about their well-being beyond just selling them a policy.

5. Support Your Clients Through Their Claims Process

As a health insurance broker, your job doesn’t end after the policy has been sold. Your clients rely on you to support them throughout their claims process as well. This is where good customer service can make all the difference.

- Make sure your clients know what to do when they need to file a claim and offer guidance in navigating the process.

- Be available for any questions or concerns they may have.

- Follow up with them regularly until their claim is settled.

By providing exceptional customer service during this time, you’ll build trust and loyalty, which will go a long way in retaining your client base.

Final Thoughts

By marketing these 5 essential skills of giving options, showing expertise, helping focus on businesses, educating clients about policies and supporting through claims procedures, you can establish yourself as a trusted partner. And ultimately grow your business while serving as a valuable resource for those who depend on you most – your clients!

About Inshura

Inshura is a FREE online ACA insurance tool, perfect for agents and agencies! Agents can boost their ACA and other enrollments using this easy-to-use solution for quoting, enrolling, automating renewals, and managing clients!

And inshura is CMS EDE PHASE III certified, so it automatically exchanges data directly from the Marketplace.