Accessible, Affordable, and Attainable

One of the key achievements of the Affordable Care Act (ACA) was the introduction of health insurance subsidies. For health insurance bought on the Marketplace, Obamacare subsidies lower the cost of monthly premiums for ACA plans. As a result, Marketplace health insurance is more accessible, affordable, and attainable for a larger number of people.

Subsidies are based on income level

The ACA allows those with low to moderate incomes, who would otherwise not qualify for insurance through their employer or Medicaid, to enroll without having to worry about the cost. There are two types of subsidies for Marketplace insurance (also known as Obamacare or ACA insurance) — premium tax credits and cost-sharing subsidies.

Subsidy Option #1 – Premium tax credits

One type of ACA plan subsidy is the Premium Tax Credit. It allows people at one to four times the Federal Poverty Level (FPL) to qualify for a subsidy on their monthly premiums. This then reduces the amount they pay for their premiums each month for Marketplace plans.

In 2020, for example, if an individual made between $12,760 to $51,040 or a family of four’s combined household income is between $26,200 and $104,800, these customers were likely eligible for a subsidy through the Premium Tax Credit. In turn, the cost of their health insurance premium would be lower each month.

Premium tax credits do not, however, apply to catastrophic health plans. Catastrophic health plans offer lower monthly premiums than standard metal tiered plans. Only certain people can qualify for catastrophic plans:

- People under the age of 30

- Those with a hardship exemption

- Those with an affordability exemption

If you qualify for a catastrophic plans, you will see those plans displayed as part of your options when you shop the Marketplace. But if you qualify for premium tax credits, you will not be able to apply those to these catastrophic plans.

Marketplace plans are tiered into four “metal” levels of coverage — Bronze, Silver, Gold and Platinum

- Bronze plans have the lowest monthly premiums, but come with higher out-of-pocket costs for enrollees when they use their plan. This ratio changes as you go up through the silver and gold tiers.

- Platinum plans, conversely, have the highest monthly premiums, but lowers out-of-pocket costs associated with care.

Your premium tax credits can be applied for any metal-level Obamacare plan. These plans are available only through the Marketplace or a verified Marketplace partner. When you shop for a health insurance plan in the Marketplace, you will see the reduced amount for your monthly premiums based on the premium tax credit for which you qualify.

Subsidy Option #2 – Cost-sharing subsidies

Silver-level Marketplace plans are also often eligible for what’s known as Cost Sharing Reductions, which are extra savings that lower the amount you have to pay for copays, deductibles, and coinsurance. It’s important to note that only Silver plans are eligible for these extra savings, which also lower the out-of-pocket maximum you will pay for your health care services before your insurance plan starts to pay 100% of your costs.

Cost-sharing subsidies reduce a family’s out-of-pocket costs when they use health care services. This means reductions on deductibles, copayments, and coinsurance. Because of the added subsidies available for silver-level plans, they can hold the same amount of value as a gold or even platinum plan.

Eligibility for premium tax credits

For tax years 2021 and 2022, the American Rescue Plan of 2021 (ARPA) temporarily expanded eligibility for the premium tax credit by eliminating the rule that a taxpayer is not allowed a premium tax credit if his or her households income is above 400% of the Federal Poverty Line.

To be eligible for the premium tax credit, your household income must be at least 100 percent and, for years other than 2021 and 2022, no more than 400 percent of the federal poverty line for your family size, although there are two exceptions for individuals with household income below 100 percent of the applicable federal poverty line. Remember that simply meeting the income requirements does not mean you’re eligible for the premium tax credit. You must also meet the other eligibility criteria.

- Not have access to affordable coverage through an employer (including a family member’s employer)

- Not eligible for coverage through Medicare, Medicaid, or the Children’s Health Insurance Program (CHIP)

- Have U.S. citizenship or proof of legal residency

- If married, must file taxes jointly in order to qualify

Eligibility for cost-sharing subsidies

For 2022, you may qualify for cost-sharing subsidies if you already receive a premium tax credit subsidy and have a combined household income between 100% and 250% of the FPL. Cost-sharing subsidies are only available to lowest-income Obamacare enrollees who meet the requirements for the premium tax credit and also purchase a silver-level plan.

Subsidies and taxes

These subsidies are based on your estimated income for the year. If your income ends up being different than what you estimated, then the subsidy amount will be reconciled on your income tax returns when you file with the IRS. If you estimated your annual income to be lower than it was, you may have to pay some of the subsidy back. If you estimated your income to be higher than it was, then you may get an additional subsidy in the form of a tax credit.

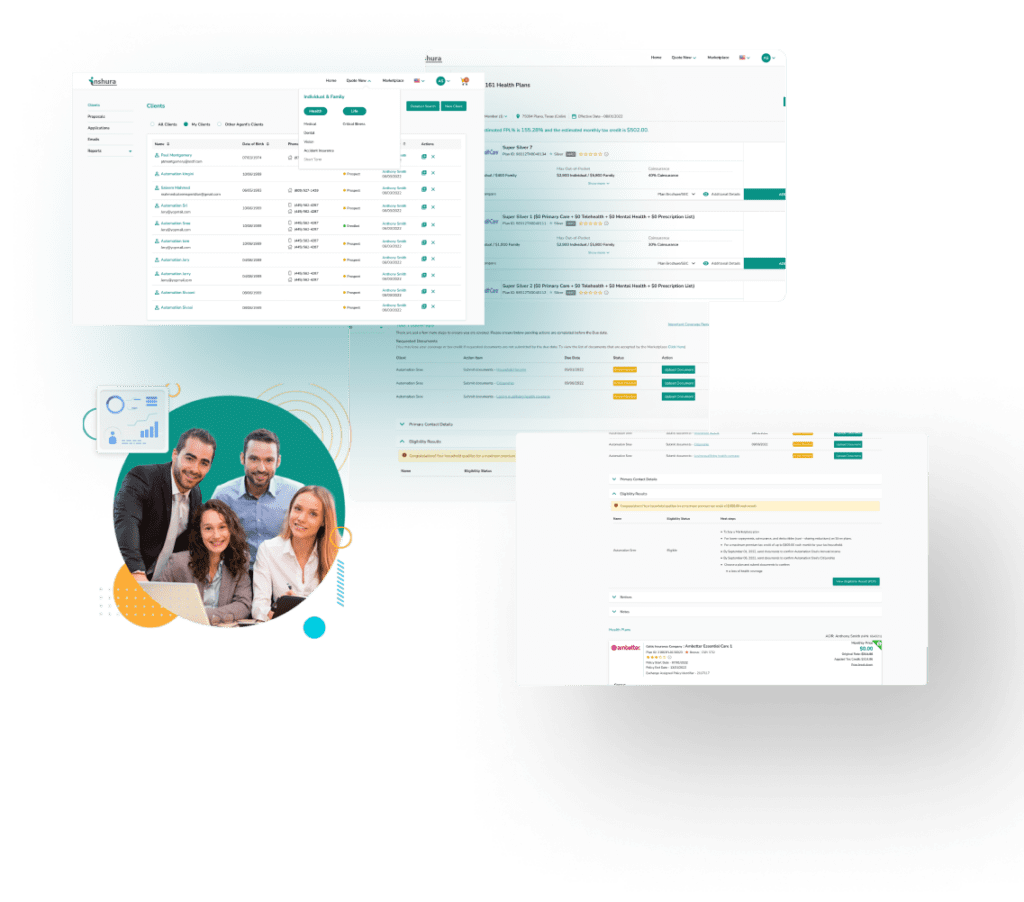

About Inshura

Inshura is a FREE online ACA insurance tool, perfect for agents and agencies! Agents can boost their ACA and other enrollments using this easy-to-use solution for quoting, enrolling, automating renewals, and managing clients!

And inshura is CMS EDE PHASE III certified, so it automatically exchanges data directly from the Marketplace.