Generic Info

ACA

You:

• must live in the United States.

• must be a U.S. citizen or national (or be lawfully present).

Under the ACA, individuals of all income levels can sign up for health insurance. If your household income is between 100% and 400% of the federal poverty level (FPL), you may be eligible for a premium tax credit or other special subsidies that will lower your health insurance costs.

II. What are the key things to consider?

Complying with the Affordable Care Act can be a challenge for small businesses, as rules change frequently and it’s not always easy to understand the legalese associated with the ACA. Work with an experienced insurance broker who can help you understand the law and find the best health insurance for your business. This is the best way to make sure you comply.

III. State-Based Exchange

State-based exchange means a state runs a state-based marketplace and is responsible for performing all marketplace functions for the individual market. Consumers in these states apply for and enroll in coverage through marketplace websites established and maintained by the states.

IV. What is a subsidy?

Health insurance is expensive and can be hard to afford for people with lower or moderate income, particularly if they are not offered health benefits at work. In response, the Affordable Care Act (ACA) provides for sliding-scale subsidies to lower premiums and out-of-pocket (OOP) costs for eligible individuals.

V. Types of Subsidies

There are two kinds of ACA subsidies: Advance Premium Credits and Cost-Sharing Reductions. The more common kind, Advanced Premium Credits, can help pay ACA health insurance premiums purchased on the Marketplace through the year.

VI. Who qualifies for a subsidy?

Subsidy eligibility is based on income (ACA-specific MAGI). To qualify for a subsidy, a household must have an income of at least 100% of the federal poverty level (or above 138% of the federal poverty level in states that have expanded Medicaid).

What are OEP and SEP?

There are two set times to buy a health plan each year. The first is the Open Enrollment Period (OEP), which runs November 1 – January 15 each year and is the time when everyone can buy a health plan. The second is the Special Enrollment Period (SEP). The SEP runs January 16 – October 31.

Special situations [Inclusion or exclusion criteria]

A Health Reimbursement Arrangement (HRA) isn’t traditional health coverage through a job.

Your employer contributes a certain amount to the HRA. You use the money to pay for qualifying medical expenses. For some types of HRA, you can also use the money to pay monthly premiums for a health plan you buy yourself.

You must have health coverage to use the HRA.

For certain types of HRAs, you (and possibly other household members) must be enrolled in a health plan (like one you bought through the Marketplace) to use the HRA money.

It’s important to understand your options before you act.

You could pay more for coverage, use more tax credits than you qualify for, or face tax penalties unless you understand your options. The decision guide below can help you.

II. Employer Sponsored Coverage

The term “employer-sponsored coverage” refers to health insurance obtained through an employer—the most common way Americans get insurance. Employer-sponsored coverage includes not only insurance for current employees and their families but can also include retired employees. Further, federal law gives former employees the right to stay on their employer’s health insurance, at their own expense, for a time after leaving a job. That, too, is employer-sponsored coverage.

III. ICHRA

Individual coverage HRA (ICHRA) is a formal group health plan that allows organizations of all sizes to reimburse their employees, tax-free, for their individual health insurance premiums and potentially other qualifying medical expenses.

For an applicable large employer (ALE) who needs to satisfy the Affordable Care Act’s employer mandate, an ICHRA is a great solution. Whether you choose to offer your ICHRA as a stand-alone benefit to all your employees or as a separate benefit for your employees who don’t qualify for your group health insurance coverage (such as remote employees in states beyond your main office or part-time employees), an ICHRA benefit meets the requirements of the mandate.

Off-Exchange & Ancillaries

Buying an off-exchange plan may make sense if the plan is the only one that covers your doctor or if the plan costs less than a comparable on-exchange policy.

II. What are ancillaries?

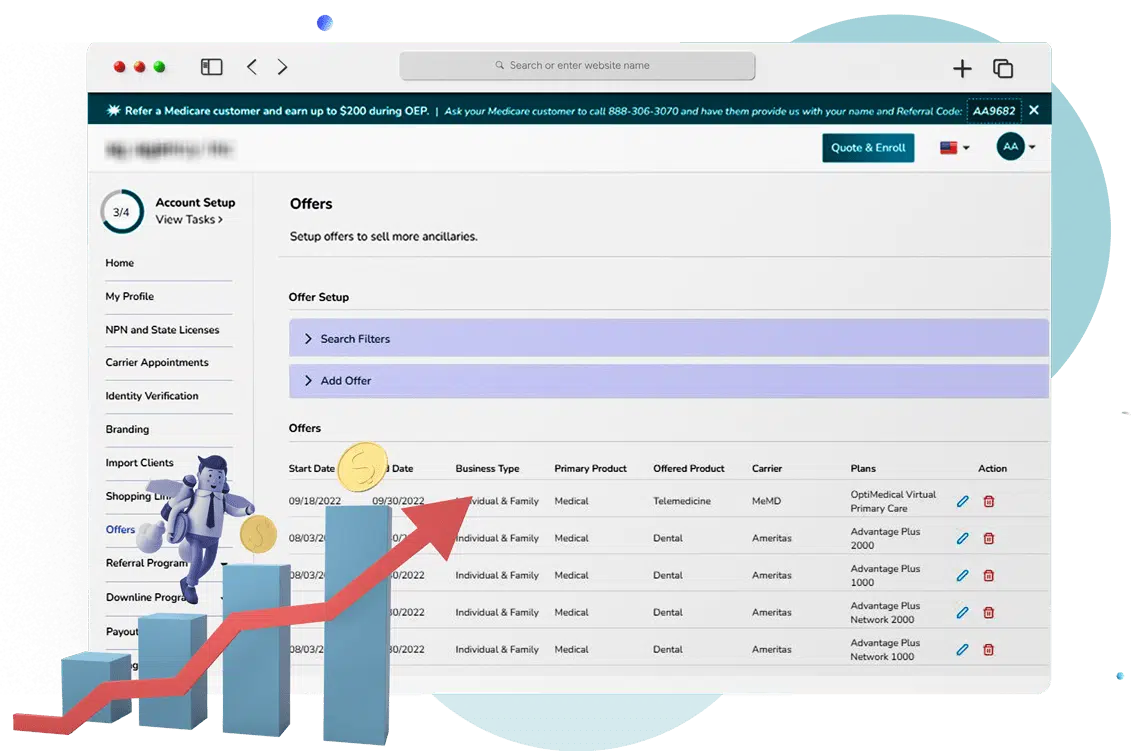

Ancillary benefits are a secondary kind of coverage used to supplement group health insurance. Ancillary benefits cover the miscellaneous medical expenses that occur during a hospital stay that are not included in a healthcare policy.

III. How can I apply to purchase an off-exchange or ancillary plan?

If you buy your health insurance through the health insurance exchange in your state (on your own or with the help of a broker or enrollment counselor), it is considered an “on-exchange” plan. If you buy it directly from the insurance company (on your own or with the help of a broker), it’s off-exchange.

Useful links

https://www.healthcare.gov/

In the news

Frequently Asked Questions

Content always open

.

If Inshura is free, how do you make money?

We provide Inshura for FREE to all Agents and Agencies.

You pay Nothing, Nada, Zip, Zilch.

Here’s how it works:

- You enter your NPN, Licenses, and Carrier appointments – You are the AOR.

- If there is someone you have a business relationship with (For example – someone in your Agency), you can configure Inshura to use their NPN for specific carriers. (Inshura has no participation in this.)

- You can add/change your Carrier/AOR at any time should you attain a direct appointment.

- The carriers will continue to pay you directly – EXACTLY the same way they are doing now, NOTHING CHANGES.

If you participate in our Optional Programs: The Client Referral Program and our Downline Agents Program, then Inshura will be the AOR.

The Client Referral Program:

- You immediately have access to many more carriers and plans to serve your customers better.

- You probably don’t have appointments with every carrier. Referring clients to Inshura or one of our partners gives you access to more plans from a broader range of insurance providers.

- You receive your referral payment quickly, and Inshura shoulders all of the long-term risks.

- Plus, you can RECLAIM the customer each year and receive ANOTHER Referral fee each year!

Inshura’s value-added services expand your income opportunities.

Is Inshura fully integrated with the ACA marketplace?

Yes! We fully integrate with the healthcare marketplace (Healthcare.gov). Inshura is CMS EDE PHASE III certified and provides secure, FAST access to the data you need – and you never have to leave Inshura.

Will you reach out to my clients?

Unless you specifically request that we do so for some reason. Our success is based on your long-term business and we work hard to keep that trust. Your business is safe and secure.

If you participate in the Client Referral Program, the new AOR (or their representative/enrollment verification personnel) will contact the referred client.

Transferring clients to a new AOR requires the new AOR to contact that client and verify eligibility.

Before joining the program, you review the full details in the Client Referral Program Agreement.

What training do I need?

We designed inshura to be so easy that training should be needed.

Just in case, we’ve included training videos that will jumpstart your success. You can also join our live Webinar training sessions!

And, of course, we’re here to help with any questions!

(888) 306-2590

support@inshura.com

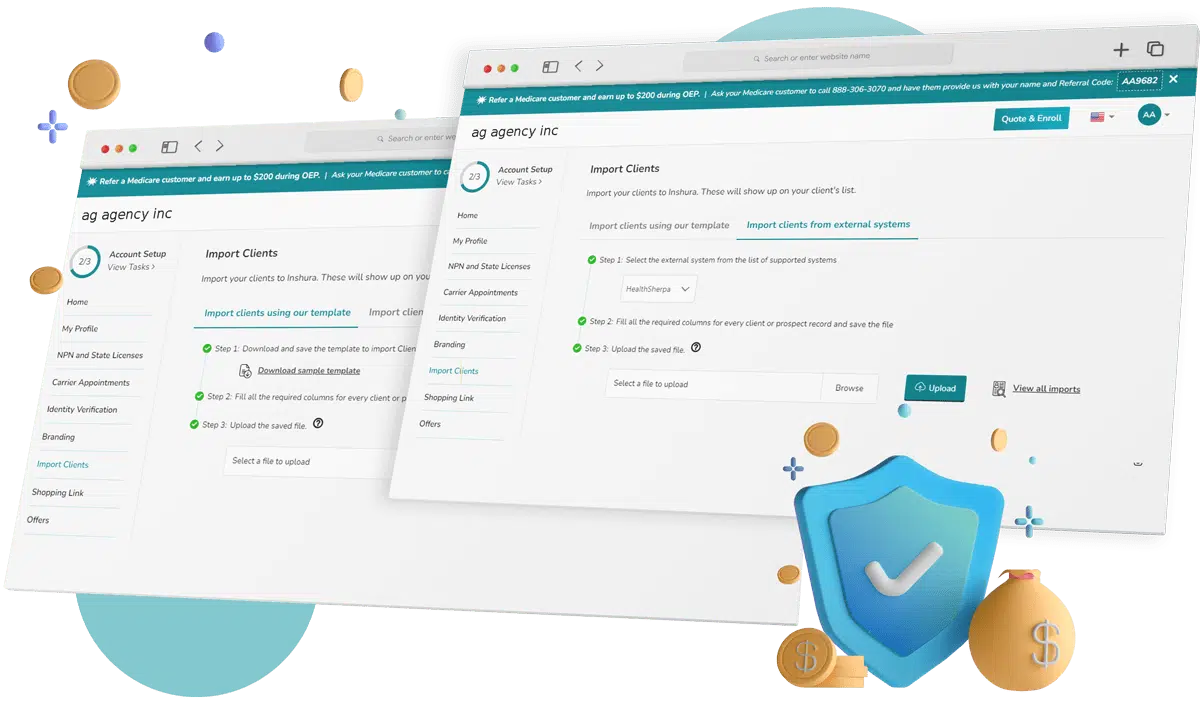

Can I transfer my client base from another system to Inshura?

Yes. Check out this Training Video to see how easy it is to import your current Book of Business!

How do I map the carriers that I am appointed with?

In the Carriers Appointments section, simply select your carriers for each State.

Who is the Agent on Record?

You.

You keep your customers and commissions.

YOU are the AOR (unless you’re working with a partner – then, of course, your partner would be the AOR.) The AOR gets the commission – just like it should be!

If you participate in our Optional Programs: The Client Referral Program and our Downline Agents Program, then Inshura will be the AOR.

The Client Referral Program:

- You immediately have access to many more carriers and plans to serve your customers better.

- You probably don’t have appointments with every carrier. Referring clients to Inshura or one of our partners gives you access to more plans from a broader range of insurance providers.

- You receive your referral payment quickly, and Inshura shoulders all of the long-term risks.

- Plus, you can RECLAIM the customer each year and receive ANOTHER Referral fee each year!

Inshura’s value-added services expand your income opportunities.

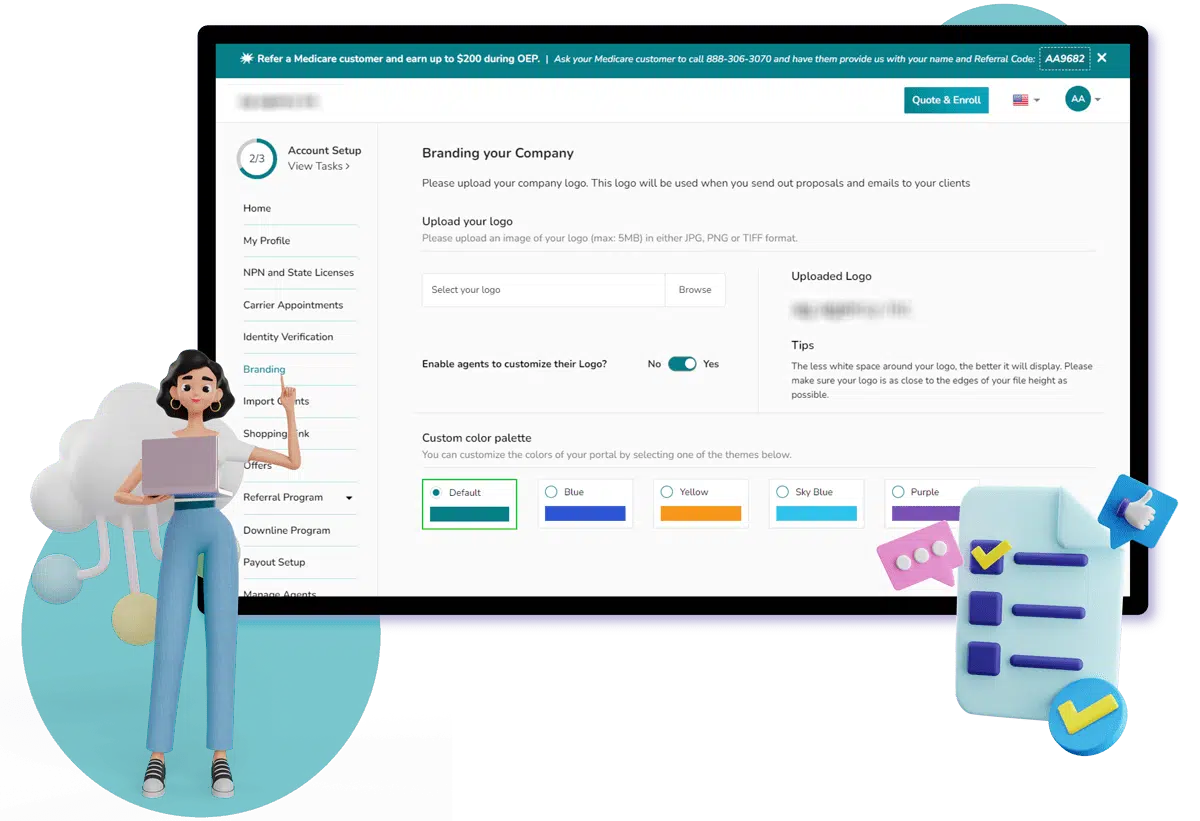

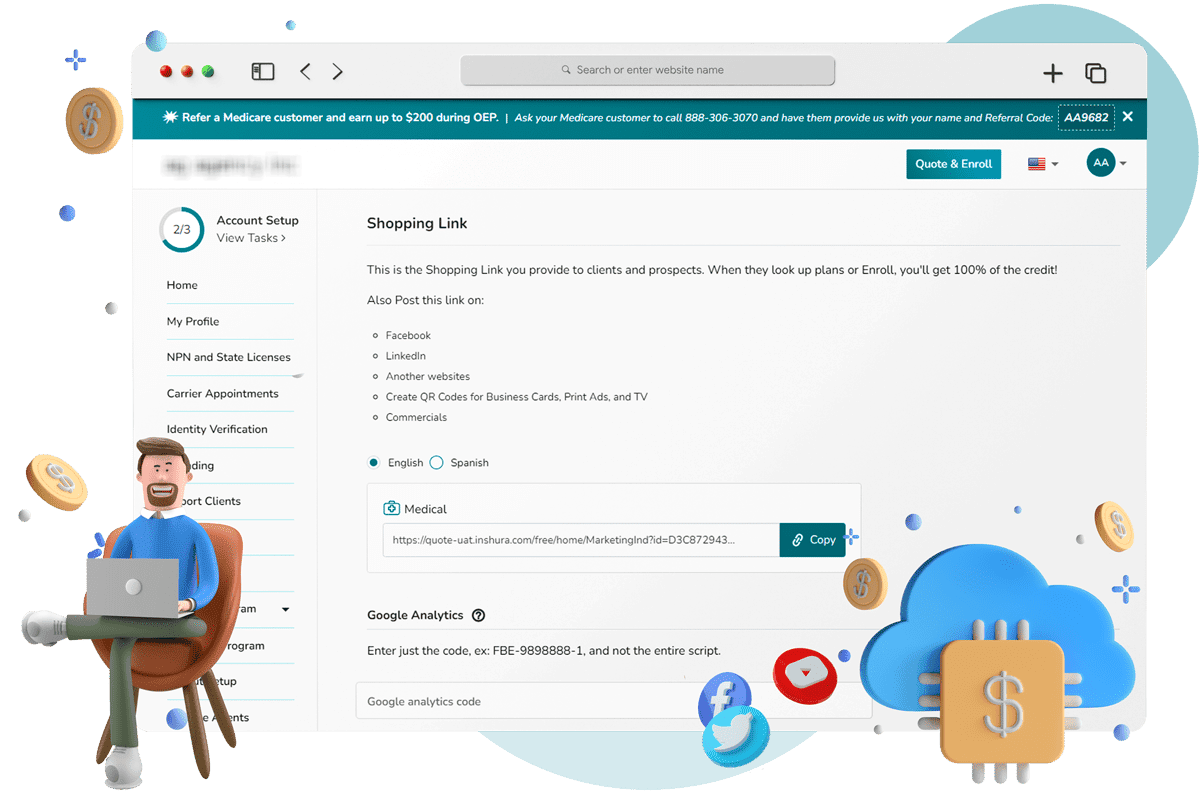

Do I get my own personalized webpage?

Yes!

Inshura creates a fully personalized, unique web page for you. You can tailor the look and feel, add your logo, and more! With inshura, you get your own unique Customer Portal!

Plus, all your email messaging is automatically personalized with your Logo, Contact info, everything! (and still no extra fees)