The Affordable Care Act (ACA) states that insurers must utilize a minimum of 80 percent of their income on healthcare claims, with the remaining less than 20 percent utilized for administration, marketing, and of course, profits. This Medical Loss Ratio (MLR) provision of the ACA requires that any excess profits are rebated to their insured. The MLR percentage adjusts further to a minimum of 85 percent for large group insurers and health Insurance Consumers.

Health Insurance Consumers

For 2022, ACA health insurers can anticipate $1 billion in rebates this fall to be made to consumers who purchased insurance in 2021. The rebates are issued based on a three-year average, so 2022’s rebate will utilize insurance data from 2019, 2020, and 2021. This amount is a significant decrease from last year’s rebate of $2 billion, partially due to profit losses from the COVID-19 pandemic.

The bulk of the funds to be paid out will be done by individual marketplace insurers covering more than four million people at an estimated $603 million. Whereas small- and large-group insurers will pay the remaining amount to their plan holders, also covering approximately four million people.

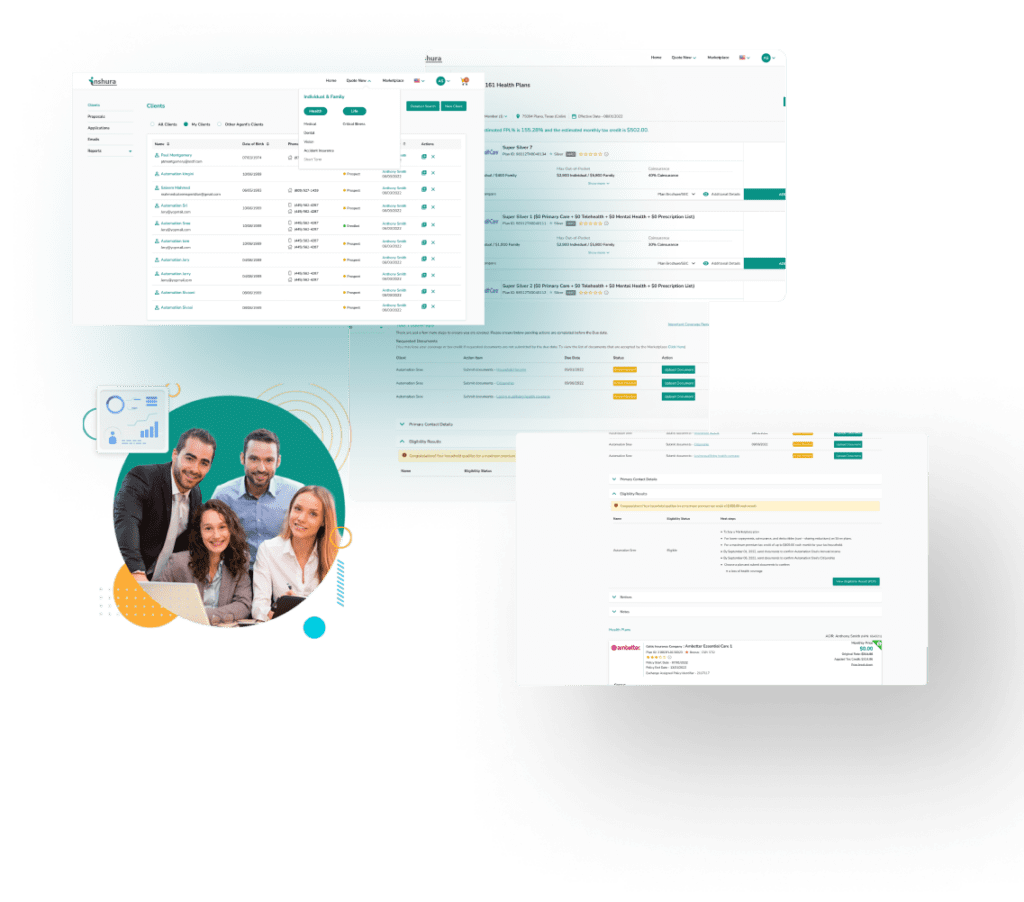

inshura is a new FREE online ACA insurance tool, perfect for agents and agencies! Agents can boost their ACA and other enrollments using this easy-to-use solution for quoting, enrolling, automating renewals, and managing clients!

And inshura is CMS EDE PHASE III certified, so it automatically exchanges data directly from the Marketplace